Hey there, fellow adventurers, thrill-seekers, and aspiring entrepreneurs! Welcome to the grand quest of business formation – an exhilarating journey where uncharted territories await and where every step feels like a leap into the unknown.

Starting a business isn’t merely setting sail on uncharted waters; it’s about embarking on an odyssey where your ideas and dreams collide with the realities of the business world.

It’s a journey filled with twists, turns, and moments of triumph, reminiscent of a thrilling saga or an epic quest from your favorite fantasy novel.

Now, at the beginning of this grand expedition, one of the foremost decisions you encounter is choosing the right business structure – a pivotal choice that lays the foundation for your entire adventure. It’s akin to selecting the perfect gear for a challenging hike or gearing up for an epic quest where every tool you carry matters.

So, fasten your seatbelts, tighten those shoelaces, and prepare for a journey filled with discoveries, challenges, and the thrill of untapped potential. Get ready to navigate through the labyrinth of business structures, each offering its own set of advantages, challenges, and opportunities.

Which structure is right for my small business?

It’s not just about choosing a structure; it’s about setting the course for your unique adventure in the dynamic world of entrepreneurship.

Keep it simple with a Sole Proprietorship

Imagine yourself as the lone ranger in a sole proprietorship – it’s like being the solo superhero behind your business. This structure is straightforward and super common among new ventures. As the sole proprietor, you’re the business itself – no separation between you and your brainchild. You call the shots, set the vision, and steer the ship. It’s a bit like having all the control in your hands, which can be liberating and empowering.

With great power comes great responsibility

However, being the sole captain of the ship also means bearing all the responsibilities and liabilities solo. You’re accountable for every decision, every success, and every stumble along the way. The business’s profits are yours to celebrate, but so are the losses and debts. Think of it as shouldering the weight of the adventure all by yourself. It can be a thrilling ride but comes with its own set of risks and challenges.

Running a sole proprietorship often involves minimal paperwork and formalities compared to other structures, making it an attractive choice for those who prefer simplicity and autonomy. It’s a fantastic starting point for small-scale ventures, freelancers, consultants, or anyone venturing out on their own with a relatively low risk appetite.

Pro Tip #1

A lot of businesses start as sole proprietorships. Most find that as they want to scale up, their needs change and they elect to change to a different structure. That is OKAY! Businesses can change as they grow. They should change as they grow.

The beauty of a sole proprietorship lies in its simplicity and flexibility. You’re the master of your fate and the captain of your ship, steering the course of your business according to your vision and instincts. While it may not offer the same level of liability protection as other structures, the freedom it provides can be invaluable in the early stages of your entrepreneurial journey.

Take a friend on the journey with a Partnership

If you’re not venturing solo, a partnership might just be your thing. It’s like having a trusty sidekick on your adventure. This setup lets two or more individuals share ownership, responsibilities, and profits, forming a dynamic duo or a team of allies pooling their skills and resources.

Partnerships come in different flavors – you’ve got the general partnership, where everyone’s equally liable, or the limited partnership, where some partners have a bit of liability protection. In a general partnership, each partner shares the workload, decisions, and even the liabilities. It’s a true partnership where everyone’s in it together, sharing the risks and rewards.

On the other hand, a limited partnership offers a tiered system where some partners have limited liability, shielding their personal assets from certain business obligations. Typically, these limited partners have less involvement in the day-to-day operations and decision-making, often taking on more of an investor role.

Find partners that complement your skills

The beauty of partnerships lies in synergy – the pooling of diverse skills, expertise, and resources. It’s like teaming up with someone who complements your strengths and covers your blind spots. Decision-making is shared, which can bring valuable perspectives and ideas to the table. However, with shared ownership comes shared responsibility – successes and setbacks are experienced together.

Partnerships thrive on trust, communication, and a shared vision. It’s essential to have a solid partnership agreement in place, outlining roles, responsibilities, profit-sharing, and dispute resolution mechanisms. When partnerships are formed with clear expectations and a shared commitment to success, they can be a formidable force in the business world.

Pro Tip #2

Partnerships can be tough! Plenty of friendships have been destroyed when they went into business as partners. Set clear boundaries and expectations. Put it all in writing. Hold each other accountable.

Reduce the risk with a Limited Liability Company (LLC)

Now, the LLC structure is the cool hybrid of business structures – it’s like combining the best features of different superheroes into one. As an LLC owner, you get the ease of a sole proprietorship or partnership, but with the added perk of liability protection. Your personal assets stay safe from any business-related debts or legal shenanigans. It’s like having a security blanket for your adventures.

In an LLC, you’re the proud owner of a business entity that shields your personal assets from the liabilities of the company. This means that if your business faces a lawsuit or incurs debts, your personal savings, property, or other assets are generally protected. It’s like having a force field that keeps your personal and business worlds separate.

Choose your pain. You get to elect how you are taxed.

One of the fascinating aspects of an LLC is its flexibility in management and taxation. You can choose how you want your LLC to be taxed, whether as a sole proprietorship, partnership, S corporation, or even a C corporation in some cases. This flexibility allows you to tailor the tax structure to best suit your business and financial goals.

Pro Tip #3

Unless you’re an accountant, go talk to one about your tax situation before making a decision about how to handle taxes for your business (and yourself). A good tax accountant knows way more about navigating taxes than most of us ever will.

Another perk of an LLC is its relatively relaxed administrative requirements compared to a corporation. There’s no need for a board of directors or regular shareholder meetings. Plus, you have the freedom to structure your LLC in a way that fits your specific needs, whether that involves multiple members, single-member ownership, or a management structure that suits your business dynamics.

The beauty of an LLC lies in its versatility and protection. It offers a middle ground between the simplicity of sole proprietorship/partnership and the liability protection of a corporation. For many small businesses and startups, an LLC is a popular choice due to its combination of protection, flexibility, and ease of operation.

Set yourself up for scale with a Corporation

Think of the corporation as the Avengers team of business structures – it’s a whole squad with shareholders, directors, and officers. It stands as its own legal entity, separate from its owners. This structure offers limited liability for shareholders, protecting their personal assets. But, just like assembling a superhero team, it involves more formalities and paperwork.

In a corporation, the business exists independently of its owners, offering a level of liability protection that can shield shareholders from personal liability for the company’s debts or legal issues. Shareholders own the corporation through shares and have the potential to benefit from its profits through dividends.

Pro Tip #4

If you’ve got aspirations of taking your company public with an epic IPO, this is probably your huckleberry. Publicly traded corporations are the ones on the stock market that you can just go buy a piece of right now. You may notice a surprisingly large number of corporations registered in Delaware where corporate taxes have been favorable.

However, running a corporation involves more formalities and administrative duties compared to other structures. You’re required to hold regular shareholder meetings, maintain detailed financial records, and comply with various state regulations. It’s like the corporation comes with its own set of rules and regulations that you need to abide by, making the administrative side a bit more complex.

Get access to funding by selling stock in your business

One of the standout features of a corporation is its ability to attract investors by issuing stock. This allows for more significant potential for growth and expansion as it’s easier to raise capital through the sale of shares. The separation between ownership and management allows for a structured hierarchy, with a board of directors overseeing major decisions and officers managing day-to-day operations.

The beauty of a corporation lies in its structure and potential for growth. While it might involve more administrative work and formalities, it offers significant advantages in terms of liability protection and the ability to attract investors. For those aiming for substantial growth and envisioning a larger-scale enterprise, a corporation could be the perfect fit.

Find tax savings with an S Corporation

The S Corporation is like picking a special power-up during your quest to maximize tax benefits. It’s not a separate structure but a unique tax designation. Opting for an S Corp allows for pass-through taxation, where business profits and losses flow through to individual tax returns.

In an S Corporation, profits and losses pass through to shareholders in proportion to their ownership stake. This means the business itself doesn’t pay federal income taxes. Instead, shareholders report their share of the company’s profits or losses on their personal tax returns. It’s like taking a shortcut through the tax maze, potentially leading to lower overall taxes.

However, not everyone can hop on the S Corp train. To qualify, your business must meet specific criteria set by the IRS, including having a limited number of shareholders, being a domestic corporation, having only one class of stock, and ensuring shareholders are U.S. citizens or residents.

S Corps can have some extra tax benefits

One significant advantage of an S Corporation is the potential tax savings. Since profits and losses pass through to individual tax returns, shareholders might pay less in self-employment taxes compared to a sole proprietorship or partnership. It’s like optimizing your tax strategy for maximum benefit.

Another perk is that S Corporations can offer certain fringe benefits to employees/shareholders, such as healthcare and retirement plans, which can be deducted as business expenses. However, keep in mind that S Corporations have stricter ownership restrictions compared to other business structures, and violating these could lead to losing the S Corp status.

The beauty of an S Corporation lies in its tax advantages and flexibility. It’s a great option for small to mid-sized businesses seeking tax benefits while maintaining the structure of a corporation. However, it’s crucial to comply with all IRS regulations and consider the implications before opting for this tax status.

Now that you know the options, you have to select the right structure for you.

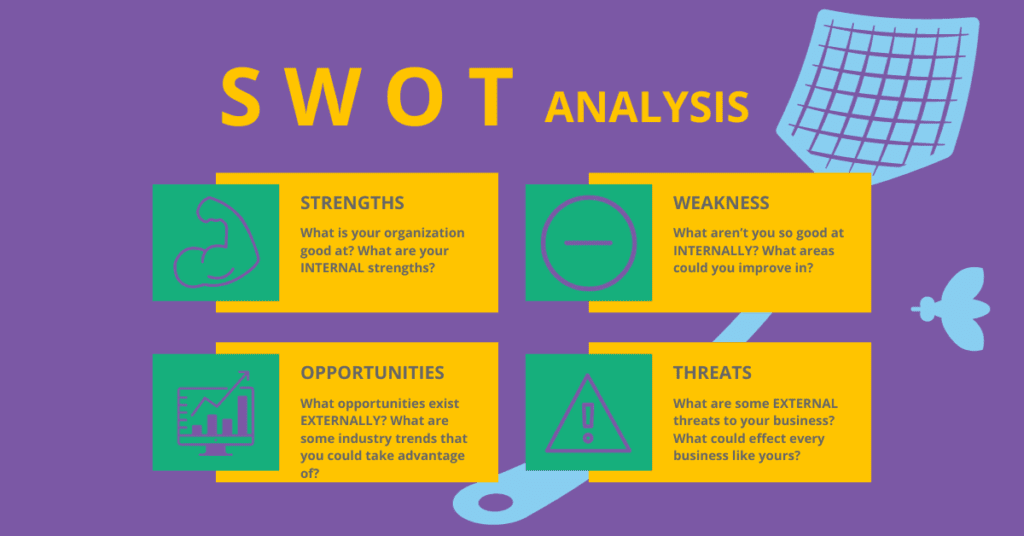

Choosing your business structure is akin to selecting your hero outfit for this thrilling journey into entrepreneurship. Here’s an in-depth exploration of the factors to consider for making an informed decision:

- Liability: The level of risk you’re comfortable with concerning business debts and legal responsibilities is a critical factor. Assessing your risk tolerance is crucial. For instance, in a sole proprietorship, you have complete control, but you’re personally liable for all business debts. Conversely, forming an LLC or corporation can separate your personal assets from business liabilities, offering a layer of protection.

- Taxes: Each business structure carries its own tax implications. Consider which structure aligns with your tax goals. For example, a sole proprietorship or partnership involves simpler tax filings but doesn’t offer the same tax advantages as an S Corporation or LLC. Analyze how each structure’s tax benefits or obligations may affect your overall financial picture.

- Control and Management: Reflect on how much control you desire over business decisions and whether you’re open to sharing decision-making with partners or shareholders. Sole proprietors enjoy full autonomy but bear the burden of making all decisions. In contrast, corporations involve a structured hierarchy, with shareholders having a say through votes and directors overseeing management.

- Ease of Formation: Consider your tolerance for paperwork and administrative tasks. Some structures, like sole proprietorships and partnerships, have minimal formalities, making them relatively easy to establish. Conversely, corporations entail more paperwork, including filing articles of incorporation, holding shareholder meetings, and maintaining detailed records, which might require more time and resources.

- Flexibility for Growth: Evaluate how well your chosen structure aligns with your long-term business aspirations and adaptability. Sole proprietorships and partnerships might be simpler initially but could limit future growth or access to funding. Conversely, corporations or LLCs offer scalability and attract potential investors due to their structured nature and ability to issue shares or attract capital.

Weigh the factors carefully, what is right for someone else might not be right for you

Each factor intertwines with the others and plays a vital role in shaping the trajectory of your business. Balancing these considerations based on your unique vision and circumstances will pave the way for a structure that best suits your entrepreneurial journey.

Don’t forget to seek professional guidance. You don’t have to go it alone.

This decision isn’t just a stroll in the park; it’s an adventure that benefits greatly from sidekick-level guidance. Legal and financial professionals serve as your wise mentors, equipped with the knowledge and experience to navigate the intricate maze of options and help you discover the best fit for your entrepreneurial expedition.

- Legal Counsel: Think of legal professionals as your trusty guides, leading you through the labyrinth of legalities and regulations. They possess the expertise to explain the legal intricacies of each business structure, detailing the liabilities, responsibilities, and legal implications associated with each option. Their insights enable you to comprehend the legal landscape, ensuring you make informed decisions that align with your risk tolerance and long-term objectives.

- Financial Advisors: Financial pros are like your financial compass, guiding you through the monetary aspects of each business structure. They analyze the tax implications, financial obligations, and potential benefits of different structures based on your specific business goals. Their expertise helps you navigate the financial intricacies, allowing you to optimize tax strategies, manage cash flow efficiently, and make financially sound decisions for the growth of your venture.

- Tailored Recommendations: These seasoned professionals don’t just offer generic advice; they provide tailored recommendations based on your unique business aspirations, industry nuances, and individual circumstances. By understanding your vision, they can suggest the most suitable structure that aligns with your long-term goals while minimizing risks and maximizing advantages.

- Comprehensive Understanding: Their guidance extends beyond merely suggesting a structure; they equip you with a comprehensive understanding of the implications, benefits, and challenges associated with each option. This empowers you to make well-informed choices, ensuring that your business structure aligns not only with your immediate needs but also with your future growth trajectory.

- Avoiding Pitfalls: Navigating the labyrinth of business structures alone could lead to pitfalls and unforeseen obstacles. Seeking professional guidance acts as a safeguard, helping you steer clear of potential pitfalls and legal entanglements that could hinder your progress or incur unnecessary costs down the road.

Pro Tip #5

There are tons of professionals that have deeply studied their fields. Lawyers, accountants, marketers, management consultants, supply chain specialists, financial advisors, insurance agents, executive coaches, project managers, HR consultants, branding experts, website developers…

Look, I could keep going here for a LONG time. The point is that for every decision you need to make in your business, for every challenge that you will face there is someone out there that has studied that topic. They know everything about it.

Find professionals that you trust and LET THEM HELP YOU!

Remember, while embarking on this entrepreneurial journey, having legal and financial experts by your side isn’t a sign of weakness but a testament to your commitment to making informed, strategic decisions that set a sturdy foundation for your business.

Go forth and prosper!

Choosing your business structure isn’t just picking gear; it’s about crafting the perfect strategy for your entrepreneurial journey. Each structure boasts its unique features and challenges, akin to selecting the right equipment for a thrilling adventure. Delve into the nuances, weigh the options, and with thoughtful consideration, set the stage for your business’s success.

Navigating the maze of business structures demands patience and thorough exploration. With every twist and turn, you gain insight into the advantages, limitations, and potential of each structure. But remember, this isn’t a solo expedition – expert guidance and careful planning serve as your indispensable allies.

Armed with comprehensive knowledge and the invaluable advice of legal and financial professionals, you’re equipped to make strategic decisions that will shape the trajectory of your business. The counsel of these seasoned mentors ensures that your chosen structure aligns seamlessly with your aspirations, mitigating risks and amplifying opportunities.

So, fellow adventurers, embrace the exhilaration of business formation. May your chosen structure serve as the ultimate sidekick, supporting you through the ups and downs of the entrepreneurial landscape. With a well-chosen structure and a spirit for exploration, forge ahead, conquering new horizons and paving your path to success and fulfillment in the expansive world of entrepreneurship.

Happy trails, brave entrepreneurs!

Homework

Time to do your homework!

Homework Assignment: Choosing Your Business Structure

Objective: To understand various business structures and apply this knowledge to determine the most suitable structure for your hypothetical small business.

Estimated Time: 30 minutes

Instructions:

Review the Article:

Read the provided article titled "Navigating Business Structures for Small Businesses." Pay attention to the different business structures outlined: Sole Proprietorship, Partnership, Limited Liability Company (LLC), Corporation, and S Corporation. Note down key points, advantages, disadvantages, and considerations for each structure.

Self-Assessment:

Reflect on your hypothetical business idea or an existing small business venture. Identify and jot down key characteristics, goals, and expectations you have for your business's growth, management, liability, and tax considerations.

Comparative Analysis:

Create a comparative table or list to match the characteristics of your business with the attributes of each business structure outlined in the article. Assess how well each structure aligns with your business's needs based on liability protection, tax implications, control, formation ease, and growth flexibility.

Seek External Resources:

If needed, research further or seek guidance from online resources, business advisors, or mentors to clarify any doubts or gather additional insights about specific business structures.

Decision Making:

Based on your analysis and understanding, make a preliminary decision on the most suitable business structure for your hypothetical business or the adjustments you might need to consider for an existing venture.

Write a Short Reflection:

In a paragraph or two, summarize your thought process and reasoning behind the chosen business structure. Explain why you believe this structure aligns best with your business goals, needs, and aspirations.

Additional Tips:

Take notes while reading the article to capture key points.

Use simple tables or bullet points to organize your comparative analysis.

Focus on aligning the business structure with your business goals and needs.

Don’t hesitate to seek guidance or further information if needed.